Due Deligence

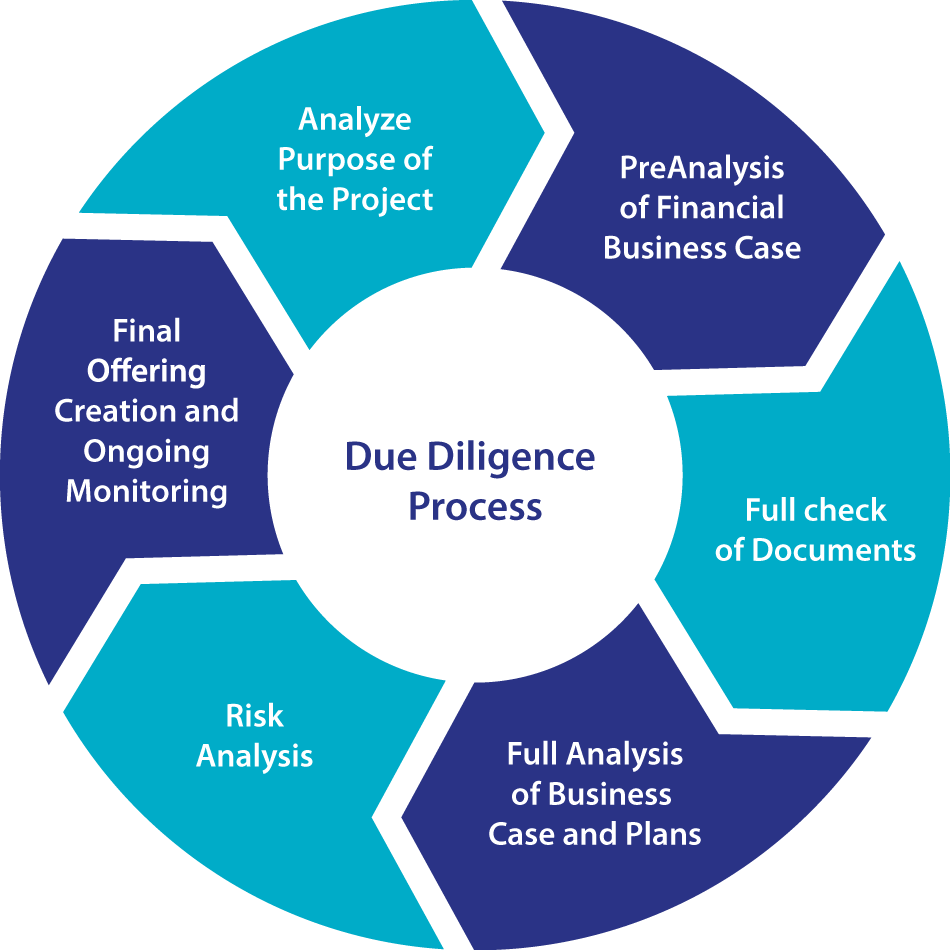

Due diligence is an audit or investigation conducted by the company of the potential product or investment being planned by it. Due diligence reviews all financial records. It is a final precaution measure undertaken before entering into agreement with another party.

Generally, these audits come before a purchase, merger or other major decision that could negatively influence the finances of one or more businesses. These audits are generally used to ensure that no hidden liabilities exist.

It can be a legal obligation, but the term will more commonly apply to voluntary investigations. A common example of due diligence in various industries is the process through which a potential acquirer evaluates a company which he has targeted or its assets for an acquisition.