International TAX Advisory

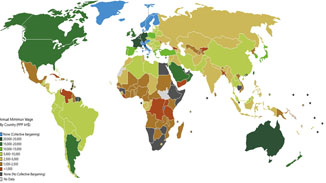

Multinational businesses are increasingly affected by tax, legislative and regulatory developments throughout the world.

If you either plan to expand your business in another country, or if you are looking to minimize the risks and the costs in your currently established international offices, you need a strong international tax planning strategy. Smart people know better than to take steps based on gut feelings alone. Financial projections are a necessity for any company. As the leader of the company you need to know how your finances will look the next year.

Economic Substance Regulation Advisory

On 10 August 2020 the UAE Cabinet of Ministers issued Cabinet Resolution No. 57 of 2020 and Ministerial.

More

Country-By-Country (CbC) Advisory

Cbc Reporting requires large Multinational Groups of Entities (MNEs) to file a CbC Report that should provide a breakdown of the Multinational.

More